Mygiftcardsite.com Website is the Place where Prepaid Gift Card Holders or VISA & MasterCard Gift Cards can Manage their Cards Online.

The Prepaid Gift Cards Permits you to purchase what you need, When you need, all Around Prepaid Gift Cards is acknowledged inside the USA only.

www.mygiftcardsite.com Website Provide You the Current adjust and all the more so the Transactions going before the transaction.

This information can likewise be attained by Calling the Guarantors toll-free number and Asking for the Gift Card Offset. Despite the fact that not considered a safe model, there are many security instruments that are placed set up to discover you are the good Gift Card Manager.

Mygiftcardsite is the Official Website of US Bank from where you’re Able to Register, Activate, Manage & Check Your Gift Card Balance Online.

This Website is an initiative of the US Bank to provide all the Essential information related to their account anytime. For instance, it gives information Regarding Your Prepaid Gift Card Balance and other Account Details.

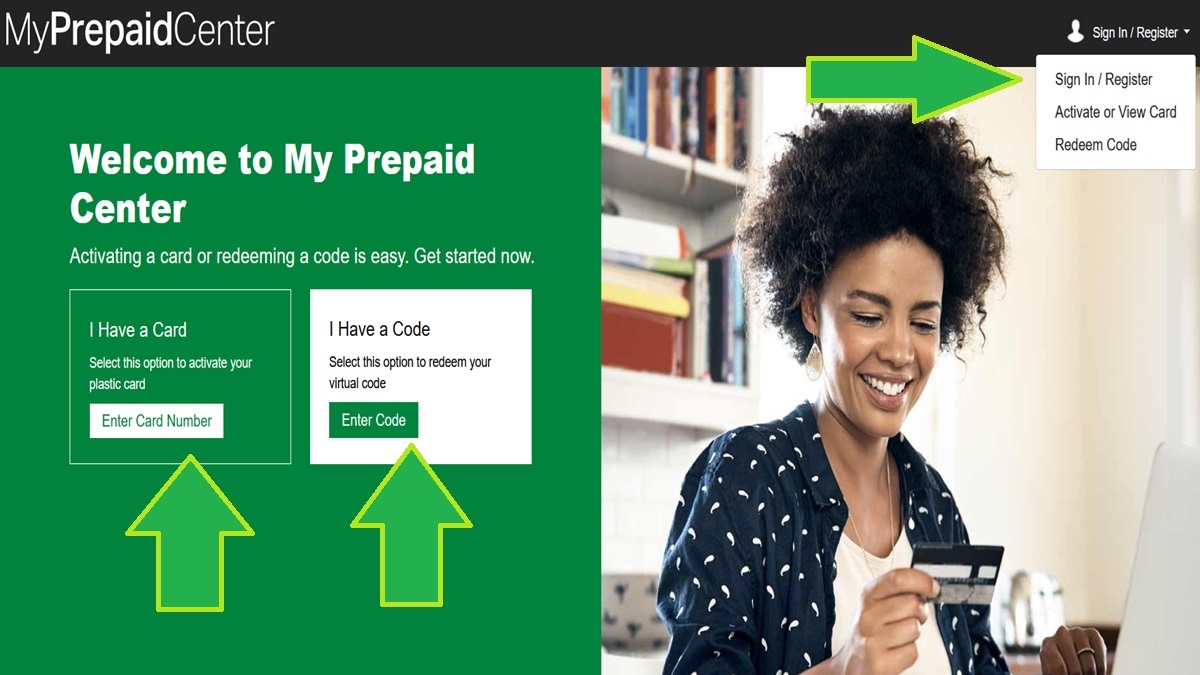

In order to avail this facility, you need to Create Account on the www.mygiftcardsite.com. And Once you will Create Your Account at Mygiftcardsite, you need to Login to the website.

For Logging In at Mygiftcardsite.com website, You need Your Gift Card Number and Card Security Code. After Logging into the Website, you have to go to the options. There you will find, Check your Gift Card Balance. Use that to Check your Card balance.

Mygiftcardsite: Manage Your Gift Card-

Once You are Able to Activate your Gift Cards at Mygiftcardsite, If You’re Looking To Manage your Gift Cards Online, then you need to follow a step by step process.

Believe its quick and simple method you ever come across. To begin with, first, you have to go to the official website. For that matter type the address www.mygiftcardsite.com in the Google search engine.

Once the site will open, you will find a block asking for some Details like Your Gift Card Number and Card Security Code. The Step By Step for Register Your Prepaid Gift Card Online is Given Here.

Now Fill up these Details and Press for Logging in Your Account. There you are at right page displaying all your Account Details.

How to Check Gift Card Balance at mygiftcardsite.com-

Simply you need to visit to mygiftcardsite.com website and once there, log in by entering the card number and the card security code (as well as the captcha code).

Once You are logged in, you will be able to see your card’s Balance. The Complete Step by Step Procedure For Checking Your Gift Card Balance At Mygiftcardsite Is Provided here.

Access Card Statement at mygiftcardsite.com-

In Order to Access your card’s statement at Mygiftcardsite, you need to Logging into mygiftcardsite.com Website by providing Your Prepaid Gift Card’s Number and Card Security Code.

Also, You need to Enter a Captcha code. Once you are Logged in, click to indicate that you want to get the statement, and the same will be availed to you online.

MyGiftCardSite Customer Service-

If you’ve any Problem to Manage your Gift Cards at Mygiftcardsite simply You can Contact their Customer Agent at: 866-952-5653

Mygiftcardsite – Frequently Asked Questions (FAQs)-

Question: What are the Prepaid VISA Gift Cards?

Answer: This acts as a prepaid card that can be used to create cashless transactions. This is a card that you can use to buy what you want whenever and wherever you are. Just a tip: this is only available for stores that are based in the United States.

Question: What makes the Prepaid Visa Gift Card different from others?

Answer: When you purchase a store gift card, you can expect that you can only purchase from that same store. This gift card, however, can be used to buy from different stores and retailers. Once again, this can only be used for US based stores.

Question: Is the Prepaid Visa Gift Card a Credit Card?

Answer: No, the Prepaid Visa Gift card should be considered more as a prepaid card as it only carries a certain amount and it can never be reloaded. Each time that the gift card is used by the recipient, that is the time when the balance will be deducted from the total amount loaded into the card.

Question: In what denominations are the card sold?

Answer: There are different denominations that are available in $15, $20, $25, $50 and $100. The load cards can have a value of $20 to $500.

Question: Why is www.mygiftcardsite.com not working properly?

Answer: In This case, You should call Customer Service On 866-952-5653 or you can change your Browser because this website requires the Use of Pop-UP Windows to provide you Additional information. If you’re Using Pop-UP Blocker Software with your Browser you may not Able to view All the Information.

Question: Can the cards be reloaded?

Answer: No.

Question: Should I register my card?

Answer: We recommend that you register your card at www.mygiftcardsite.com or you can also call their customer service at 1-866-952-5653. Registering your card will allow you to use it even when you are shopping through your phone or other gadgets.

Question: Can I see where I have used my card?

Answer: In order to check your current balance, you can check www.mygiftcardsite.com. Remember that there is no charge with trying to connect with them through their website or by calling them through a phone.

VISA Gift Card-

Question: How does my Prepaid Visa Gift Card work?

Answer: You can simply give this to the cashier and choose credit. You can also sign the receipt and press debit and enter your PIN. Every time you use your card, your card’s balance becomes deducted by the total amount that you have used.

Question: Can this be used in order to get cash at the ATM?

Answer: No. You cannot withdraw cash even if you are using a pin code.

Question: What will happen if I do not have enough money to complete the purchase?

Answer: If you are purchasing in person, you may add the needed amount to complete the purchase while the gift card’s funds will become 0. For online transactions, you may have to know exactly how much your balance is before you can make a purchase.

Question: What happens when all of the money on the prepaid card has already been spent?

Answer: The card cannot be used anymore.

Question: Can I use the Prepaid Visa Gift Card at gas stations?

Answer: You may but only if you pay at the counter and not through the pump. If you pay at the pump, $75 will be deducted automatically and if you do not have this amount, you will be declined.

Question: Can I use the card at restaurants?

Answer: Yes but if you go to a restaurant or any other establishment wherein tipping is already considered normal, an additional 20% may be added to your total bill in order to cover the costs.

Question: Can I use my Prepaid Visa Gift Cards to rent a car or to make hotel reservations?

Answer: There are other forms of payment that are recommended if you are planning to rent a car or to make hotel reservations. You cannot use the card for those transactions.

Question: What will happen if I decide to return something that I purchased with the use of the card?

Answer: The funds will be returned to the card as long as you still have the card with you. It will take about 2 – 3 business days before the funds will be returned so just be patient.

Question: What happens if I have already thrown the card away?

Answer: This will depend on the retailer from which you have purchased the item you want to return.

Question: What if I don’t agree with the things listed in my credit card statement?

Answer: Contact customer service at 1-866-952 – 5653. There will be helping you uncover some of the things listed on the statement.

Question: What is the Prepaid MasterCard Gift Card?

Answer: This is a prepaid card that has a value limited to the amount of money that was loaded to it in the first place. This can be accepted by most stores and retailers in the United States provided that these stores are only located in the US.

Question: Can I use the card to purchase from more than one store or merchant?

Answer: Yes, as long as this type of card is accepted and as long as you are using it at stores or merchants that are based in the United States.

Question: What do I do if my Prepaid Visa Gift Card is declined?

Answer: You can double check the balance first by calling 1 – 866 – 952 – 5653. You can also check www.mygiftcardssite.com. You may want to speak to a customer service representative regarding your card if you have any more concerns.

Question: What if my card gets lost or stolen?

Answer: If this occurs, you would have to contact 1 – 866 – 952 – 5653 in order to report a stolen card. There may be some details that will be asked from you like your name, your gift card number, the original value of your card and your transaction history.

There is a replacement fee that will be applied to your total balance. If you do not report it, you will be liable for all of the purchases that will be made with the use of the card.

Question: What makes the Prepaid MasterCard gift card different from other accounts?

Answer: This is a gift card that allows you to purchase from more than one store or more than one retailer provided that these stores are only located in the United States.

Question: Why should I register my card?

Registering your card will allow you to monitor the transactions made on your card and if all of the details are correct. At the same time, you can report it as stolen or lost immediately so that further purchases will not be made with the old card as you will be given a new one.

Question: How can I see where I have used my card?

You have two options. The first option is to check www.mygiftcardsite.com and the second option is to call 1-866-953-5653. Remember that there is no charge whenever you want to check the balance of your card so you should not worry.

Question: Is the Prepaid MasterCard a credit card?

Answer: No, as this only contains a limited amount that will be deducted depending on the purchase of the owner of the card.

Question: In What denominations are the cards sold?

Answer: The usual are in $25, $50 and $100 but there are variable load cards that can go from $20 – $500.

Question: Are these cards reloadable?

Answer: No.

Question: When Will the card expire?

Answer: Yes, the card will expire. You will know the expiration date of the card by checking the detail in front.

MasterCard Gift Cards-

Question: How does my MasterCard Prepaid card work?

Answer: You can use it to pay at the cashier like a typical credit card or debit card. For credit, simply press on credit and affix your signature and for debit, choose debit and key in your pin.

Question: Can MasterCard be used to get cash at the ATM?

Answer: Even if you have affixed a password on it, you cannot use it to get cash at the ATM.

Question: What if I don’t have enough money to cover my next purchase?

It is advisable that you always check your balance first before you make any purchase but if in case you don’t, tell the cashier how much balance you still have on your card and pay for the rest of the amount through another transaction.

Question: What happens when all of the credits are spent?

Answer: The card will not be usable anymore unless there is an item that needs to be returned and the funds may also be returned to the card.

Question: Can I use the card in order to pay at the gas station?

Answer: When you do this, pay at the cashier so that the exact amount will be deducted from your card. If you pay at the pump, your card may get declined.

Question: What do I do if my Prepaid Visa Gift Card is declined?

Answer: You can double check the balance first by calling 1 – 866 – 952 – 5653. You can also check www.mygiftcardssite.com. You also have the option to speak with a customer service representative if you wish to do so.

Question: If my card gets lost or stolen, What To Do?

Answer: If this occurs, you would have to contact 1 – 866 – 952 – 5653 in order to report a stolen card. There may be some details that will be asked from you like your name, your gift card number, the original value of your card and your transaction history. There is a replacement fee of $5 that will be charged to your account. If you do not report it, you will be liable for all of the purchases that will be made with the use of the card.

Question: if I disagree with the online statement, What To Do?

Answer: Contact the customer service representative at 1-866-953-5653 upon double checking your balance at www.mygiftcardssite.com