Mortgagequestions Portal is the official web portal of PHH Mortgage which is developed for Customers who want to make comfortable and easy Payments on their Mortgages and Loans. along with Payment Customers are able to check their Payment History, Tax Rates or Interest, and other Services.

PHH Mortgage Provides industry-leading Mortgage Services and helps countless homebuyers and homeowners find Financing Solutions in an easy way. Mortgagequestions.com Website is operated by PHH Mortgage in order to Check Mortgage and Loan Status, Online Mortgage Bill Payments, and get other benefits. PHH Mortgage was established in 1977 and is Headquartered in Mount Laurel Township, NJ.

www.mortgagequestions.com website is owned by PHH Mortgage and is basically designed to Respond to Your Current Mortgage, and also gives a wide variety of Loan Choices, Including conventional, FHA, and VA. PHH Mortgage is listed among the top 5 Mortgage Organizing businesses in the United States of America. PHH Mortgage Company is known for Providing various Mortgage Options, including the 40 years Fixed Loan Rate.

Mortgagequestions Portal is available for Customers in order to make easy Payments and also Offers a Range of Various Payment Options. There are many Customers in the USA who likes to use the Services of the Mortgagequestions.com Portal in Order to Pay their Monthly Mortgage Installments.

Mortgagequestions Overview

Mortgagequestions.com is the Web Portal that is dedicated to comfortably Paying off Mortgages and Loans. If You are a Customer of PHH Mortgage then you can use the Mortgagequestions Services in order to Pay off Due Payments when it comes to Mortgages, Loans, and Texas.

If You are looking for a handy Mortgage Service that allows you to Pay Your Mortgage easily then Mortgagequestions is best for you. The Mortgagequestions Website, in particular, offers, 90 Online Services that are perfect for not only homebuyers but for Property Owners too.

Mortgagequestions Help You Find the Right Options for your Current Financial Conditions. If You are trying to Purchase a Property then You can check out the Different Services available on this Website to find the one that’s the best suited for your needs and capabilities.

You don’t need to confuse because PHH Mortgage is the Main Website while MortgageQuestions is the Online Center for the Company. So you can either go directly to www.mortgagequestions.com for Online Services or head over to PHHMortgage.com in order to check the Company Information. Mortgage Questions is the Online Service that lets Property Owners and Homebuyers get the right type of Financing Options for their current situations.

All the People who are trying to get a new Financing option or Buy a new Piece of Property are able to Check through the Various Services to get one that works out. Mortgagequestions.com is the Online Mortgage Center for PHH Mortgage. You can go to the Mortgagequestions Official website and then Click the ‘Mortgage Center Login’ Button at the Top of the Website.

About PHH Mortgage

MortgageQuestions.com is an online platform that is owned and operated by PHH Mortgage Corporation, a subsidiary of Ocwen Financial Corporation. PHH Mortgage Corporation is a provider of mortgage services that has been in operation for over 30 years. MortgageQuestions allows you to manage your mortgage account online, including making payments, viewing your account history, and updating your personal information.

What is www.mortgagequestions.com?

www.mortgagequestions.com is a website created by PHH Mortgage to provide its customers with an easy and convenient way to manage their mortgages. The website is designed to offer a variety of services, including making payments, viewing statements, updating account information, and accessing helpful resources related to mortgages. This website is specifically designed for customers of PHH Mortgage, a mortgage servicing company that manages over 1 million mortgage loans.

Mortgagequestions Features

Buying a home is one of the biggest financial decisions we make in our lives. It comes with a lot of responsibilities, including the need to keep track of mortgage payments, interest rates, and loan terms. This is where MortgageQuestions Login comes in. It’s a platform that helps homeowners manage their mortgage accounts online.

Here Below are some of the Mortgagequestions Features and Benefits:

- Get access to your Account Information 24/7.

- Review Online Payments and Statement History.

- Request Support for Online Accounts.

- Set Up the Automatic Payments.

- Get Registered in Paperless Delivery for Statements and Enjoy free Online Payments.

The Benefits of Using Mortgagequestions

Mortgagequestions Web Portal is a convenient and secure way to manage your mortgage online. Some of the benefits of using Mortgagequestions include:

- 24/7 Account Access: With Mortgagequestions login, you can access your mortgage account anytime, anywhere.

- Online Payment Options: You can make payments online, which is much more convenient than mailing a check or visiting a branch.

- Account Management: You can view your account details, check your payment history, and manage your account settings.

- Communication: You can communicate with your mortgage servicer through secure messaging.

- Financial Planning: You can use Mortgagequestions to calculate your mortgage payment, see your payoff amount, and more.

- Escrow Management: If you have an escrow account, you can manage it through MortgageQuestions Login. You can view your escrow balance, payment history, and upcoming payments.

- Contact Customer Service: If you have any questions or concerns, you can easily contact customer service through MortgageQuestions Login.

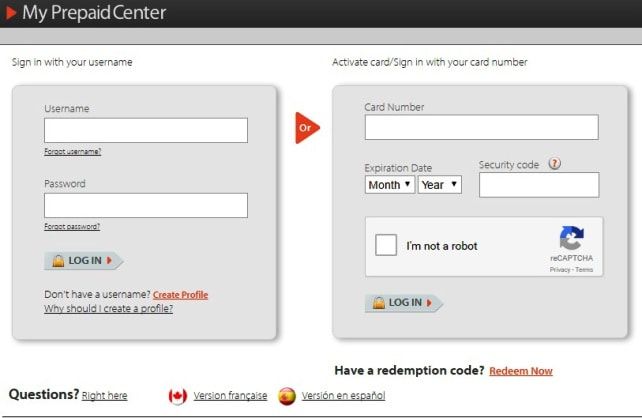

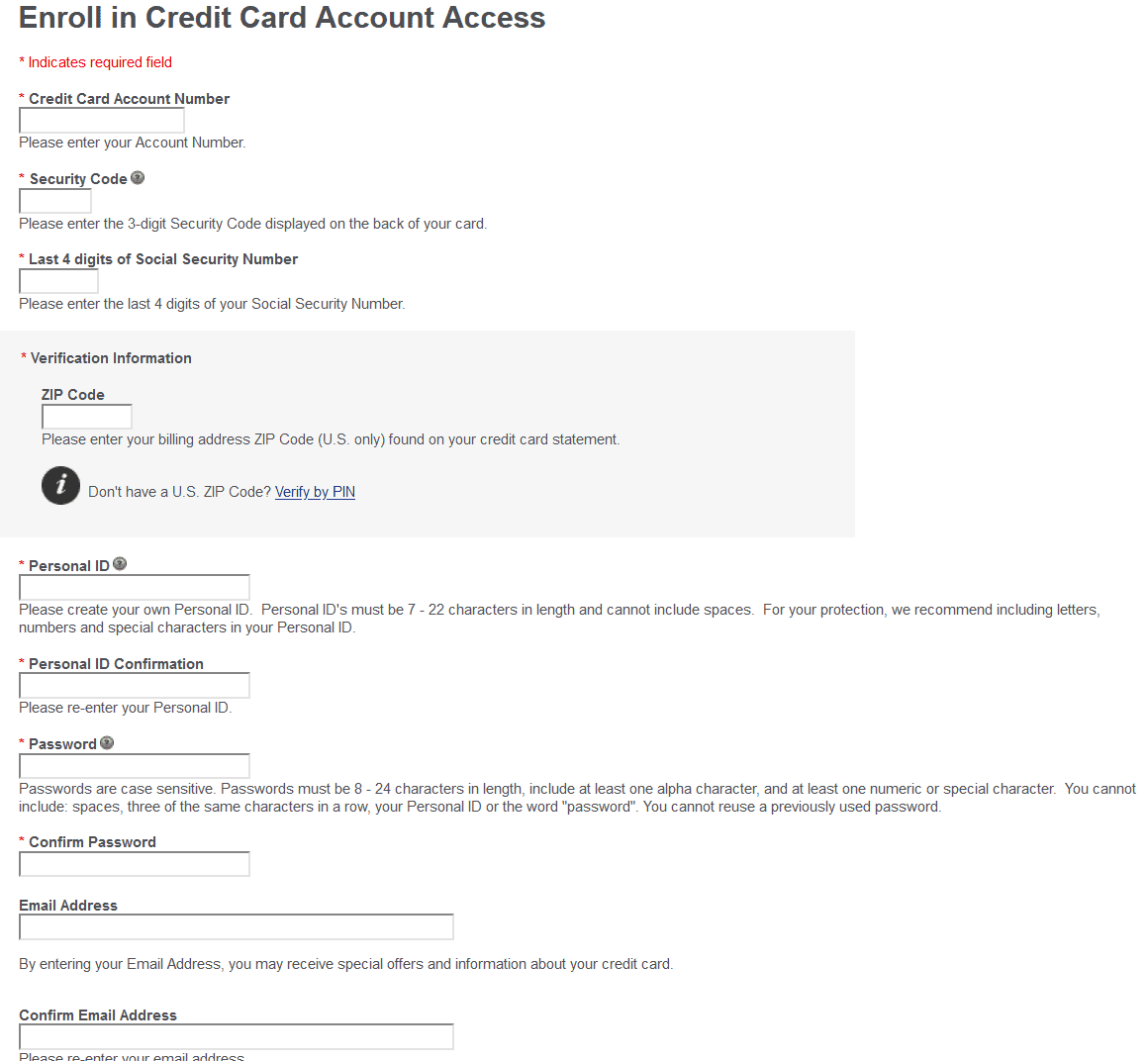

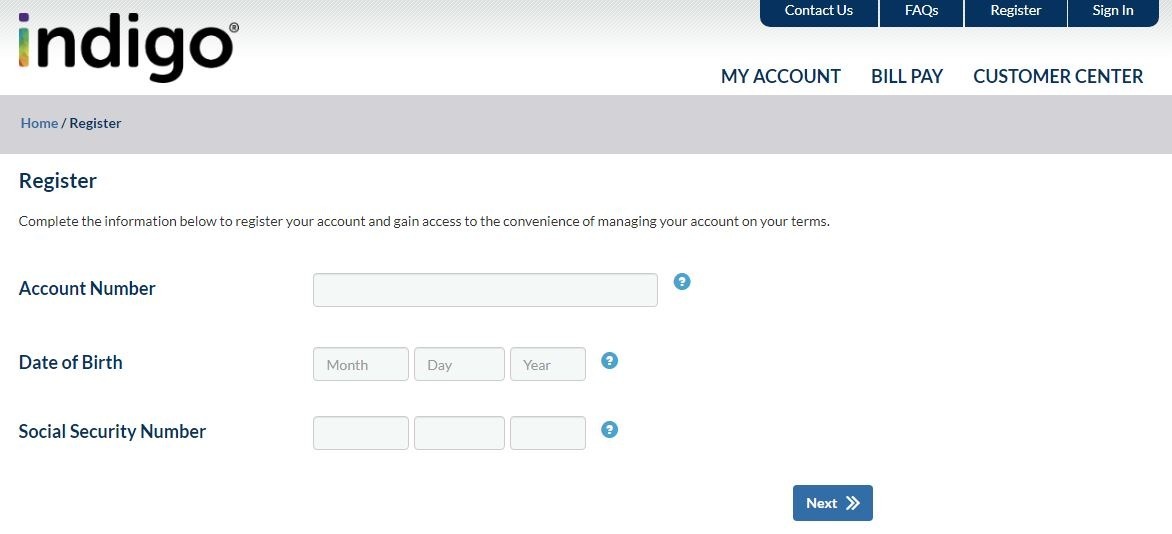

MortgageQuestions Sign Up: Registration Process

In Order to Register at Mortgagequestions.com Portal, a User must access the Mortgagequestions Web Portal and then Click on Register for Online Access. Here Below is the complete Mortgagequestions Sign Up step-by-step Process:

- Step I: At First Open Your Secure Web Browser and type in https://www.mortgagequestions.com/main/.

- Step II: Now You will be redirected to Mortgagequestions Main Page, here You will see the “Register Now” Link.

- Step III: Now Tap on the Link that says Register Your Account, which is presented below on the Login Form.

- Step IV: Now Enter Your First Name, Last Name, SSN, and your Property Zip.

- Step V: After Entering the asked details You need to Submit Your Bank Account Details because money will be debited every month from your Bank Account.

- Step VI: After Providing Your Bank Details You have to Submit Your Email ID and Mobile Number and Hit Register Button in order to Finish the Registration Process.

- Step VII: After Successful Registration, You can now easily log in to Your Account by Providing your Login Credentials and get all the Online Benefits.

Once you’ve completed these steps, you’ll be able to login to your MortgageQuestions account.

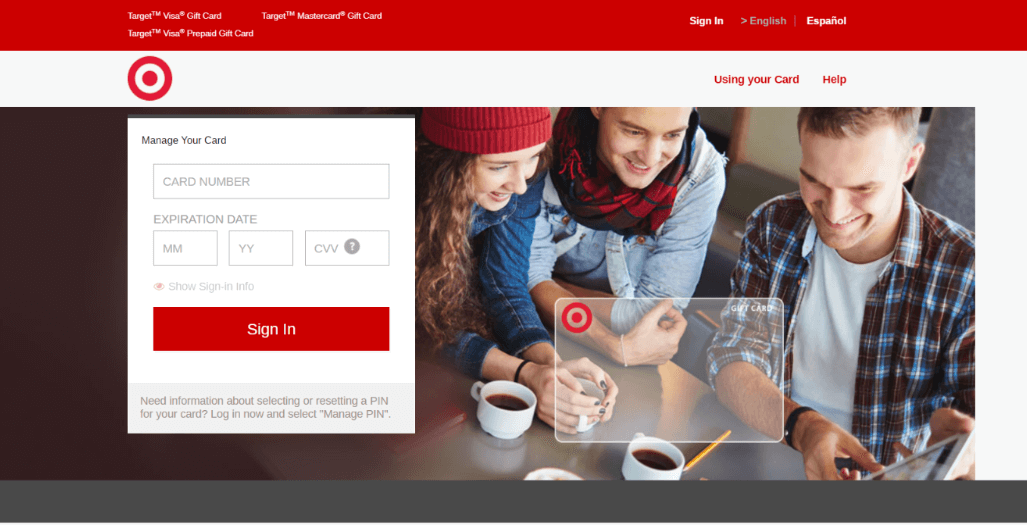

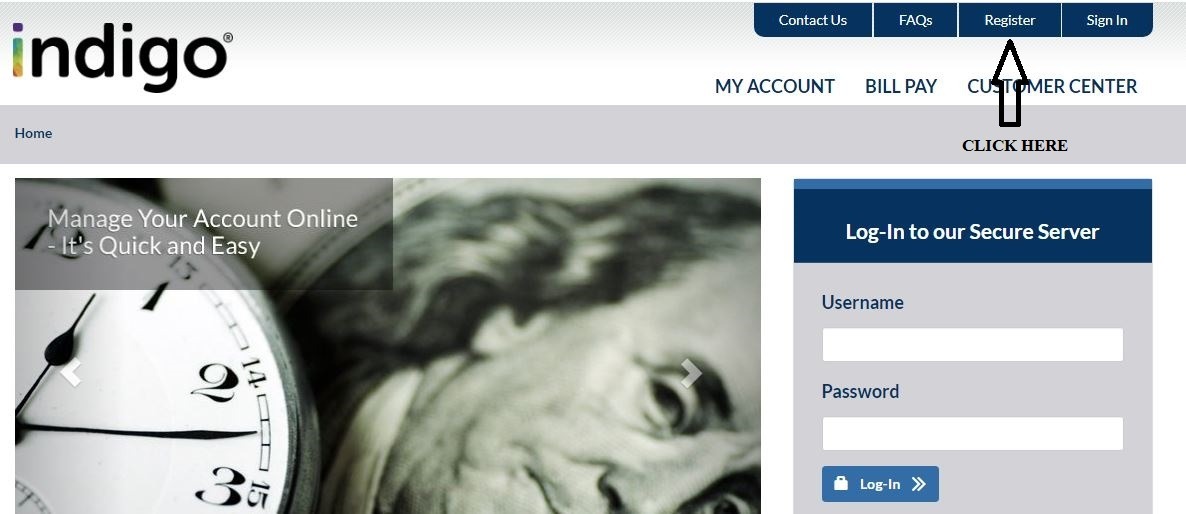

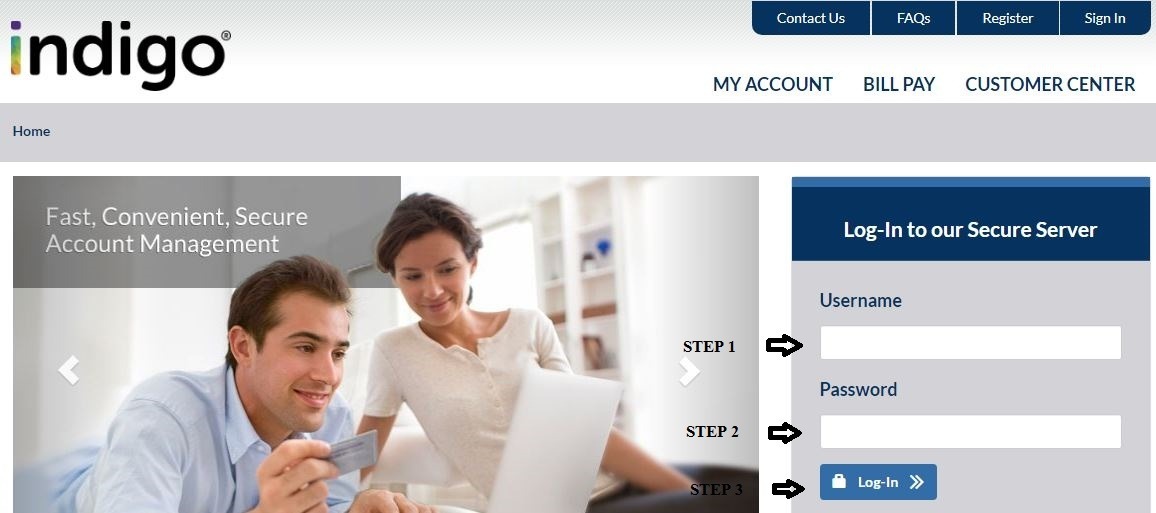

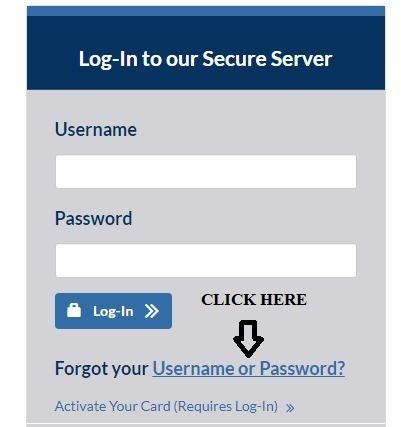

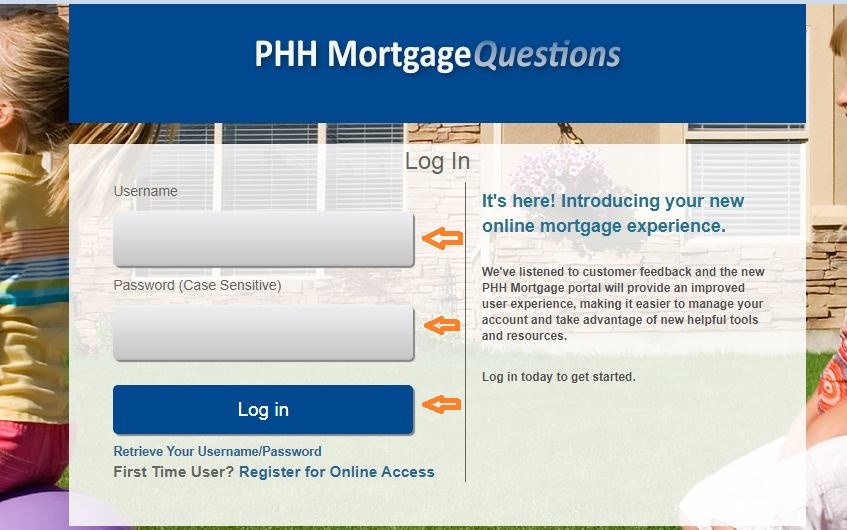

MortgageQuestions Login: Sign-In Process

In Order to login at www.mortgagequestions.com, a User must access the Mortgagequestions official web portal and Click on Login Link in order to Access Online Account. Here Below is the complete step-by-step process for Mortgagequestions Login at www.mortgagequestions.com:

- Step I: a User Must keep their Login Credentials first.

- Step II: Head Over to the official website of Mortgagquestions at www.mortgagequestions.com.

- Step III: Now Provide your Login Credentials such as Username And Password at the given Space on the Login Page.

- Step IV: Now You will Land on the Dashboard of the Website through which you can easily Make Online Payments by clicking on the Mortgage Payment Section.

- Step V: The Money will be deducted from Your Bank Account which You have already Registered at the time of Sign Up.

If you’re a first-time user, you’ll need to create an account by clicking on the ‘Register Now’ button. Follow the on-screen instructions to create your account.

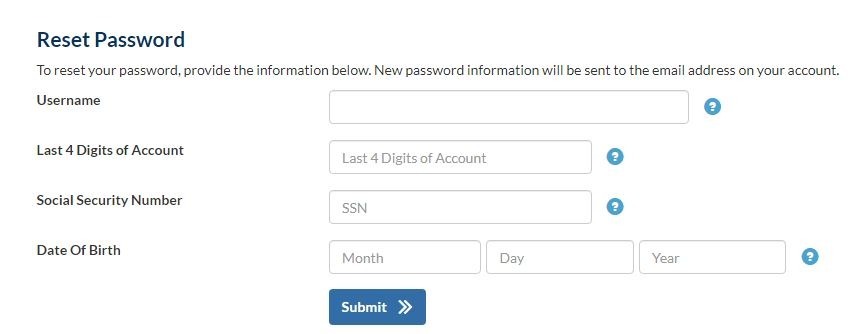

Reset Your Mortgagequestions Password

In Case You have to Forget Your Mortgagequestions Login Password then You can easily Reset it by visiting its official website. Here Below we have given a few step-by-step processes to Reset Your Mortgagequestions Login Password:

- Step I: Head Over to the official website of Mortgagquestions at www.mortgagequestions.com.

- Step II: Now, Click on the “Forget Password” Link which is present on the Homepage of the Website.

- Step III: Now Enter Your Email Address, Username, and SSN Number in the Desired Field.

- Step IV: Now Click on the Recover Button and Follow the Instructions to Recover Your Password.

Troubleshooting Tips for Mortgagequestions Login

MortgageQuestions Login is a convenient and user-friendly platform that helps homeowners manage their mortgage accounts. With its easy-to-use features and secure encryption, you can access your account information with ease. If you’re a homeowner, signing up for MortgageQuestions Login is a smart move that can help you stay on top of your mortgage payments and other related tasks.

If you are having trouble logging in to Mortgagequestions, here are some troubleshooting tips:

- Check Your Internet Connection: Make sure you have a stable internet connection.

- Clear Your Browser Cache: Clearing your browser cache can help resolve login issues.

- Check Your Username and Password: Make sure you are entering the correct username and password.

- Contact Customer Service: If you are still having issues, contact customer service for assistance.

Make Online Payment At Mortgagequestions.com Portal

After Successfully Login to Mortgagequestions.com Website, You can go ahead and look through as well as utilize all the different services. In order to make Mortgagequestions Payment Online at the mortgagequestions.com website, Follow these step-by-step processes which are provided below:

- Step I: Head Over to the official website of Mortgagquestions at www.mortgagequestions.com.

- Step II: Tap on the Mortgagequestions Login Button.

- Step III: Enter Your Login Credentials like Username and Password in the desired field.

- Step IV: Now Access your Mortgage Payment Option and Carry out the Payment Date and Amount.

- Step V: Now, Money will be Deducted From Your Bank account.

- Step VI: Your Mortgage Payment is Done.

Security and Privacy on MortgageQuestions

MortgageQuestions takes the security and privacy of your information seriously. The website uses encryption to protect your personal and financial information, and only authorized users have access to your account. Additionally, MortgageQuestions has strict policies in place to protect your information from unauthorized access, use, or disclosure.

Mortgagequestions Customer Service Support

If You have any Questions or Queries related to Mortgagequestions Sign Up, Mortgagequestions Login, or Mortgagequestions Payment then You can Contact the Mortgagequestions Customer Support Representative. PHH Mortgage also Provides a Toll-Free Number for its Customers. You can also reach them by leaving a Mail at their Email ID. here below we have given some details regarding Mortgagequestions Customer Service Support:

- Toll-Free Number: 1-800-449-8767

- E-mail: [email protected]

- Address:

Post Office Box 5452

Mount Laurel, New Jersey 08054

PHH Mortgage Headquarters

Useful Links

- PHH Mortgage questions login official website: Click here

- PHH Mortgage Official Website: Click here

Final Verdict

Here We have provided the complete details regarding Mortgagequestions I Hope you have got the complete information about the Mortgagequestions Login process. However, there might be a few situations where the user has some issues, queries, or complaints, related to their Services. then they can easily get help from Mortgagequestions Customer Services directly. in order to do so, you can call their toll-free number 1-800-449-8767. the timings to contact them are from 8:00 am to 9:00 pm (Monday to Friday) and 8:00 am to 5:00 pm (Saturday).

Frequently Asked Questions (FAQs)

- Is there a fee to use MortgageQuestions? No, there is no fee to use MortgageQuestions.

- Can I make extra payments on my mortgage using MortgageQuestions? Yes, you can make extra payments on your mortgage using MortgageQuestions.

- Can I set up automatic payments using MortgageQuestions? Yes, you can set up automatic payments using MortgageQuestions.

- What should I do if I forget my MortgageQuestions password? If you forget your MortgageQuestions password, click the “Forgot Password” link on the login page and follow the instructions to reset your password.

- Can I view my payment history on MortgageQuestions? Yes, you can view your payment history and schedule future payments through the website.

- Is my information secure on MortgageQuestions? Yes, MortgageQuestions uses encryption and has strict security and privacy policies in place to protect your information.

- Can I make payments through MortgageQuestions? Yes, you can make one-time payments or set up recurring payments through MortgageQuestions.

- Can I access MortgageQuestions Login from my mobile device? Yes, MortgageQuestions Login is accessible from any device with an internet connection, including your mobile phone.

- Can I use www.mortgagequestions.com if my mortgage is not with PHH Mortgage? No, www.mortgagequestions.com is only available to customers of PHH Mortgage.

- What should I do if I have trouble accessing my account on www.mortgagequestions.com? f you have trouble accessing your account on www.mortgagequestions.com, you can contact PHH Mortgage customer service for assistance.