MyIndigocard is the Indigo credit card login Portal for the USA residents of Indigo Cards to manage their credit cards. Users can log in at the Myindigocard portal and check their balance and pay their credit card bills. The Indigo Credit Card Login portal can be easily accessed by users and can be accessed through mobile phones, pc, or laptops. Users can add funds directly into their accounts and can also pay their bills using the portal.

Indigo Mastercard is a unique credit card from Indigo. This card is specially developed for users with less-than-perfect credit scores. Usually, credit card companies do not approve users with fewer credit scores or no credit scores. Indigo Cards are easy to get even if you have lower credit scores or no credit scores.

About Myindigocard

The Indigo Platinum Mastercard is an inexpensive yet powerful way to get your life under control. In addition to the low annual fee, it offers some fantastic features for the price, including:

- No Annual Fee Urban dining can be expensive these days with all the tabs you have running around town. Having an Indigo Platinum Visa Prepaid Card has you covered with no annual fee, so money can go towards bills or other things that may be more important to you than a shiny new card every year.

- Free Online Bill Pay You can pay bills online with the Indigo GOLD Visa prepaid card. This helps lighten your load and keep you from misplacing bills so that you can get an accurate view of your finances at all times.

- Online Account Access With the Indigo Platinum Mastercard, you have access to all of your account information securely online. You can quickly check to see how much money you have, transfer money through a teller or into another account, and view your statements from home or wherever there is an internet connection.

- International Transactions Not only is the Indigo Platinum Visa Prepaid Card low maintenance and inexpensive, but it also means far less hassle when dealing with other countries. This prepaid card has no foreign transaction fees, so you will be able to continue to do your business around the globe without the hassle of worrying about those high rates.

- Location-Based Spending You won’t have to plan for your Indigo Platinum Visa Prepaid Card. Please place a new order and then pay it when you want to at any Indigo POS location, whether in New York, Paris or Sydney. The card can be used at other approved locations as well, so there are almost limitless locations where you can use this card.

- Rewards Program The Indigo Platinum Visa Prepaid Card comes with an excellent rewards program designed for ultimate convenience. This card earns you points with every purchase, redeeming for valuable gifts, cashback, or even travel vouchers.

- Mobile Banking You can stay on top of your spending with the Indigo Platinum Visa Prepaid Card by using mobile banking whenever you have access to a mobile phone. This allows you to see your balance without going online, so if you are out on the town and don’t have time to check your account before paying for a meal or drink, it is easy enough to do it from anywhere.

- Security The Indigo Platinum Visa Prepaid Card comes with the highest level of security available in the form of EMV chip technology.

Features Of Myindigocard

MyIndigocard Portal is created for users to easily access and manage their indigo credit cards. Indigo offers various benefits to its credit card users.

The Indigo credit card login portal is created with many features to make it easier for the customers and offers the best deals with lower charges.

- Multiple credit card designs at no extra cost.

- MyIndigocard portal is available 24/7

- Chip card Technology for Fraud Protection

- Payments are reported to 3 Credit Bureaus

- No Security Deposit Required

- Easy Qualification

- Paperless Statements

- Free Online Bill Pay

MyIndigoCard Benefits

IndigoCard comes with a lot of benefits. Users can go to Indigo Login and access all the benefits and privileges that come with the Indigo card. You get 24*7 access to card statements and make payments.

-

The Convenience system

There aren’t great deals of installment strategies that can match the comfort of a Mastercard on the grounds that by the day’s end, a Mastercard is just a standard-sized ID card, which should occupy almost no space in a wallet. Because of this, Visas are fantastic for making greater buys such that cash can’t expect to coordinate.

-

Misrepresentation Security

Visa misrepresentation is a colossal worry for a ton of Visa clients. Because of this, charge card guarantors have taken impressive measures to give their items misrepresentation assurance, which ought to furnish intrigued people with some genuinely necessary inward feeling of harmony.

-

Accessibility of Assets

Generally, getting cash accompanies a tedious application process. Quit worrying about the time that it will take for cash to show up at one spot from another. Conversely, spinning types of acknowledging, for example, a Visa can be utilized something like as far as possible at whatever point and any place the purchaser satisfies, which can be a basic benefit in specific situations.

-

Boundless Acknowledgment

The Indigo Platinum Mastercard is a Mastercard, which is acknowledged by a great many sellers arranged in nations from one side of the planet to the other. This is an authentic concern since some retailer-gave Visas can’t be utilized anyplace other than the retailer.

-

Financial Record

Normally, this implies that the utilization of the Indigo Platinum Mastercard will set up a record of loan repayment, which thusly, will be utilized to compute the purchaser’s financial assessment. Do the trick to say that the FICO assessment is the critical estimation of reliability, which can improve things significantly with regards to what intrigued people can acquire just as the conditions under which they can get.

-

Low Assessment Prerequisites

Talking about which, the Indigo Platinum Mastercard is fascinating in that it accompanies lower financial assessment necessities than the vast majority of its partners, which ought to demonstrate valuable data to people who may have had some credit issues not long ago. Truth be told, the backer’s site altogether expresses that it will think about all of the financial records out there, which is fairly intriguing most definitely.

-

Get Pre-Qualified

The application for the Indigo Platinum Mastercard is basic and clear in nature. Truth be told, it is feasible for intrigued people to get pre-qualified, which gives them the choice to see a choice inside something like 60 seconds. Even better, this won’t affect their financial assessment, which is applicable on the grounds that checking the FICO rating on various occasions inside an extremely brief timeframe will in general be viewed as a notice sign by banks.

-

Loans from Indigocards

Tragically, the drawback is that the Indigo Platinum Mastercard doesn’t accompany a lot of highlights packaged into it. In any case, intrigued people should know that the loans come at a higher financing cost than standard installments, which ought to illuminate their arrangements for their Visas.

-

Custom Card Plan

Cardholders can look over various card plans. Some are distinct apparently, which are appropriate for those with more straightforward inclinations for the appearance of their charge cards. Interestingly, others are considerably more brilliant, implying that intrigued people can get something that suits them as opposed to utilizing whatever is proposed to them.

-

Access from Mobile Application

The Indigo Platinum Mastercard has a versatile application, which furnishes cardholders with the opportunity to sign into their record at whatever point and any place they please inasmuch as they have their cell phones with them. This ought to furnish them with more command over their Visas than in any case conceivable.

Credit Limit Of Indigo Platinum MasterCard

The Indigo Platinum Mastercard helps those with lower credit scores, yet adds to a framework that keeps those with low and harmed credit in an endless loop of monetary difficulty. The main consideration in the assurance of a financial assessment is the credit usage proportion: how much obligation is caused versus credit accessible.

It’s fitting never to utilize more than around 30% of accessible credit to keep a solid financial assessment. How can one do this when given a yearly expense as high as $99 on a credit breaking point of $300? Is it conceivable? Indeed, ideally. In any case, those applying for a $300 credit extension probably need essentially $100 they might not have $100 to square away a surplus that opens up another $100.

To the people whose credit has been harmed, there is no ideal world. Note that you might get a proposal for one more yearly charge through another advertising channel, similar to mail. In those cases, we’ve considered yearly charges to be high as $125. Surely, spending higher than 30% of a credit limit is a choice and for the individuals who need to do it at the expense of reliability, that is simply endurance.

Yet, that is the place where backers can trade out: when buyers are caught in the pattern of expecting to pay high yearly expenses and exorbitant financing costs to manage the cost of necessities. The yearly charges for the Indigo Platinum range from $0 to $99. None of the cards offers rewards, none proposition low basic APR, and all have a credit cutoff of just $300. The yearly expense represents a mark against this credit limit when the record is opened, as it’s charged to the record.

Gotten cards offer a protected method for holding spending under wraps with loaning presented against a security store. Bring in 3% and 2% money back on the first $2,500 in joined decision classification/supermarket/discount club buys each quarter, then, at that point, procure 1%.

This joined with its absence of a yearly expense and expandable store limit (from the base of $300 up to $4,900) help the Bank of America Customized Cash Rewards Secured card outperform the opposition. The Petal 1 card, given by Web Bank, Member FDIC, offers those with meager or reasonable records of loan repayment one more choice with its strange endorsement process.

Candidates might be assessed on something beyond FICO rating and however, it could be harder to be endorsed for than the most un-attractive contribution of the Indigo Platinum, the Petal 1’s restricted money back profit at select vendors, $300 to $5,000 credit limits and no yearly charge make it the easy decision victor in this correlation.

With correspondingly exorbitant loan costs, the two cards need rewards or low introduction APR and the relies upon financial soundness yearly charge framework, the main considerable distinction with the Indigo Platinum card is the $0 yearly expense presented on its best level. The most reduced yearly expense accessible with the Milestone Gold is $35. The two cards are a pass at every possible opportunity.

The cardholder’s credit limit at the IndigoCard is $ 300 and it isn’t clear assuming that IndigoCard pay could increment further on the web or disconnected exchanges assuming that you utilize the card at various stages. The Indigo Card does not exclusively is there any yearly expense at www.indigocard.com, yet it likewise maintains a strategic distance from a large group of different charges that the Indigo Platinum Mastercard and most different cards of this kind charge, including every one of those for abroad exchanges, late installments by the pertinent cardholders.

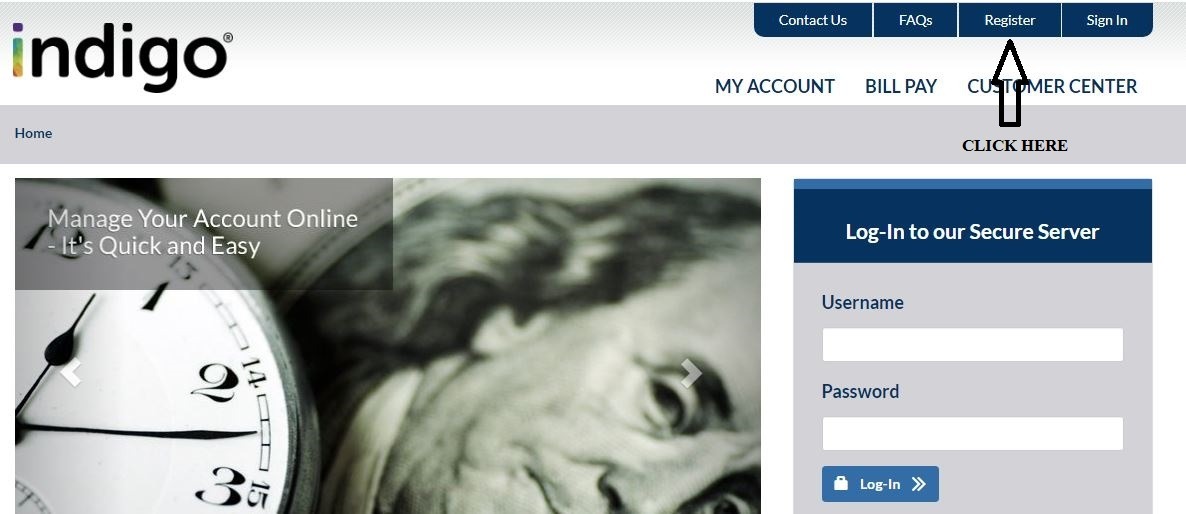

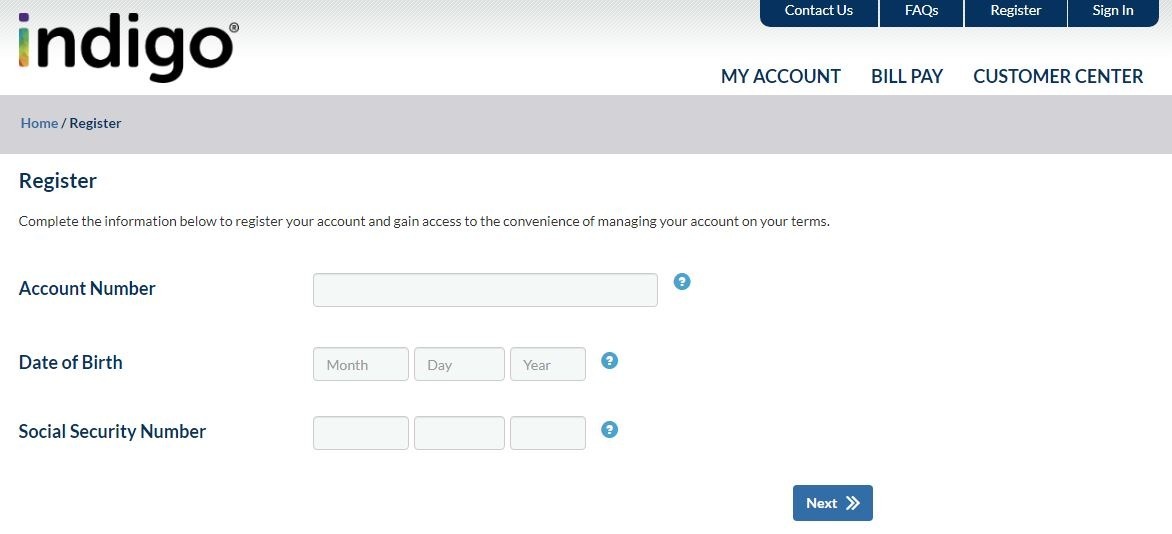

MyIndigocard Registration & Sign Up Process at www.myindigocard.com

If you are willing to apply for an Indigo credit card, you have to go Myindigocard Login portal and follow the steps below:

- Visit the Indigo Credit Card website at www.myindigocard.com

- Click on Register from the Top menu.

- Enter your account number, date of birth & Social Security Number.

- Click on the Next button to submit your details.

- Create a unique username and password.

- After registration, you will receive a confirmation email.

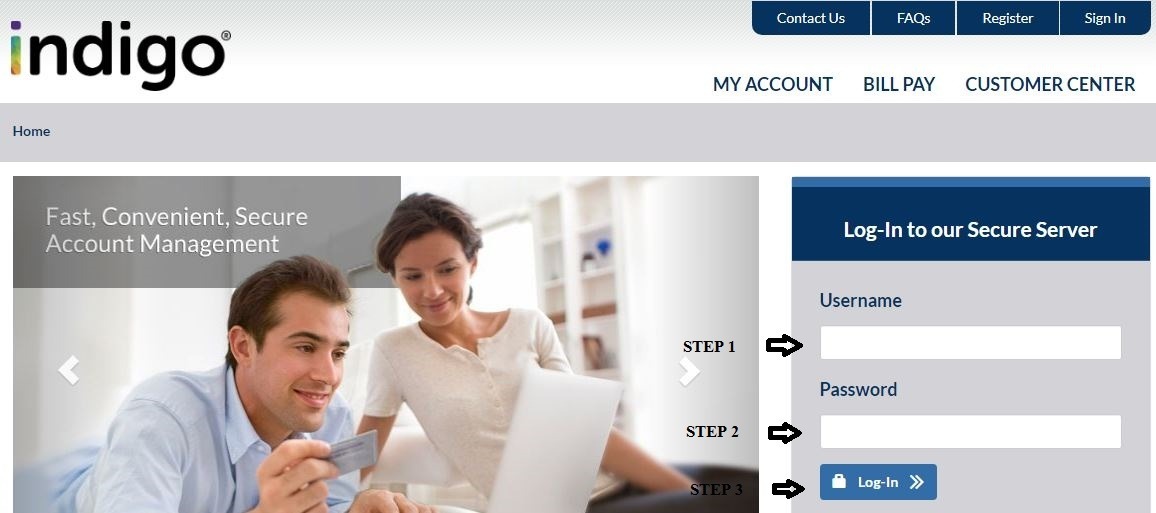

MyIndigoCard Login Process At www.myindigocard.com

If you already have an account at the Myindigocard Login portal, you can follow the below steps to log in to your account and enjoy all the benefits of the portal.

- Visit the Indigo Credit Card login website at www.myindigocard.com

- Enter your username & password.

- Click on the Log-in button.

- Now you are logged in and can access your credit card and the various other benefits of the portal.

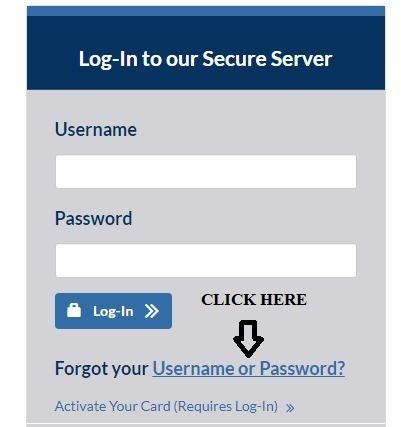

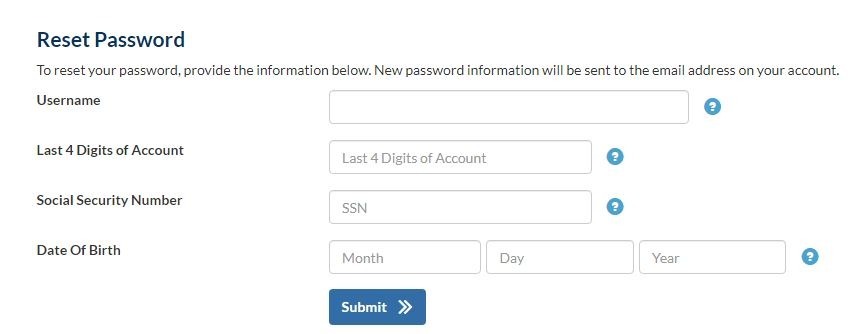

MyIndigoCard Forgot Username or Password?

If you have forgotten your username or password, follow the steps below to retrieve your username & password.

- Visit the Indigo Credit Card Login portal at www.myindigocard.com

- Click on Forgot your Username or Password?

- Enter the required details to reset your password or retrieve your username.

- After entering the required details, click on Submit.

www.myindigocard.com – MyIndigocard Activation Procedure

You can activate your indigo platinum credit card by simply following a few instructions and paying a visit to www.myindigocard.com. You can activate it in two ways. Either through your mobile phone or through the website.

www.myindigocard.com – Activation via Website

- First, be sure your mobile or laptop is connected to a reliable internet connection.

- Then open your website browser and go to the official website of indigo platinum credit card www.myindigocard.com.

- You will be required to provide your username and password.

- Furthermore, you will be asked to provide your card number, personal identification number, date of birth, and some other important details.

- After entering all the required information, you can press the Activate button.

- Your Indigo platinum credit card will be activated right away.

Activation Through Mobile Phone:

- To activate your indigo platinum credit card, you may dial the official contact number of this platinum card which is 1-866-946-9545.

- The call representatives will ask for some of the information.

- You need to provide authentic details to activate your credit card without any problem.

- After providing all the right information, your account will be activated soon.

- You can also dial this number in case of any other problem regarding the indigo platinum credit card.

MyIndigocard Customer Support & Contact Details

MyIndigocard Login is a portal from Indigo for credit card members. If you are an Indigo credit card customer and face problems accessing the portal, you can check out the customer support details below.

- Customer Service: 1-866-946-9545

- Toll-Free Number: 866-946-9545

- Lost/Stolen Department: 888-260-4532

- Fax: 503-268-4711

Bottom Lines

MyIndigocard is basically a platinum MasterCard provided by Celticbank for users who are below perfect for the management of their finances of the card. This is Platinum Card and is assigned by three major bureaus to keep the track of your financial records. That was everything related to the MyIndigoCard Login at www.myindigocard.com. I hope you like this article, and that it’s helped you a lot, but if you are facing any issue related to this MyIndigoCard login then feel free to leave a comment I like helping everyone.

Thanks for sharing!